the right place

With so much noise and conflicting expert opinion around what is happening in the property market, our analysts offer a clear picture of the economic and demographic forces at play. At Mirvac we make our investment decisions based on solid data, insights we believe should be shared with our customers so that your next real estate decision is an informed one based on fact.

Against a backdrop of challenges emerging with inflation, rising interest rates and a slowing economy, we have seen an earlier than expected end to the price correction in the established housing market. This stabilisation can be attributed to a confluence of factors including a surge in migration, very low unemployment, high construction costs and low on-market supply. A wide consensus of forecasters, including the major banks, predict prices to lift a little over 2023 before more sustained and broadbased lifts in 2024, once interest rates track lower. Now more than ever it’s important to consider where we are at in the cycle, assess the fundamentals and cast a longer-term perspective.

Source references: 1 ABS, National, state and territory population, Dec 2022. 2 Federal Budget papers 2023-24. 3 Centre of Population 2022 Population Statement. 4 ABS Overseas Migration SA2 FY15-FY19. 5 ABS, Labour Force, Australia, Detailed, May 2023. 6 NSW State Budget Papers. 7 March 2023 forecast. 8 SMH, https://www.smh.com.au/national/melbourne-tops-sydney-as-australia-s-biggest-city-on-a-technicality-20230413-p5d04g.html. 9 State budget papers. 10 ABS Labour Force population estimates. 11 CoreLogic. 12 Federal Budget Papers 2023-24. 13 Westpac-Melbourne Consumer Sentiment June 2023. 14 ABS Building Approvals, May 2023

Population - near term

After almost two years of closed borders, Australia’s population boomed with the reopening in January 2022. In the year to December 2022, the increase to Australia’s population was the highest on record with the Australian Bureau of Statistics recording 496,800 new residents. Close to 80% of the increase was from new overseas arrivals such as international students and temporary workers but the strong result was also due to fewer people leaving Australia.

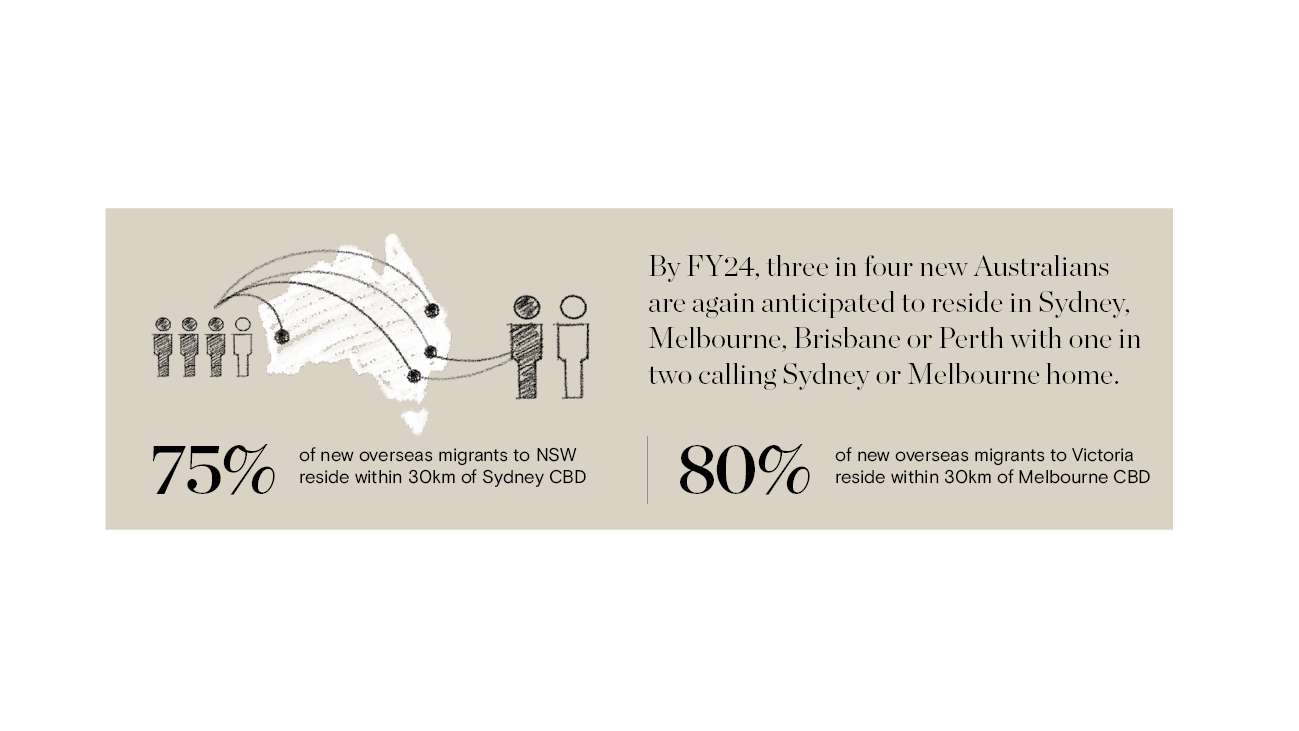

The 2023-24 Federal Budget forecast net overseas migration would reach a record 715,000 over FY23 and FY24 and close to 1.5 million in the five years to June 2027. This compares to a pre-pandemic decade average of around 225,000 per annum. In terms of the locations that will benefit from the inflow of migrants we can look to both government forecasts and historic evidence:

- The Federal Government’s official forecast assumes close to three in four new residents will choose to call

Sydney, Melbourne, Brisbane and Perth home

- Sydney and Melbourne are expected to account for around one in two of all new Australian residents

- A look back at migrant settlement patterns shows the popularity of inner and middle ring locations.

Our analysis of the locations of new overseas migrants in the five years prior to the pandemic found:

- 75% of new overseas migrants to NSW resided within 30km of the Sydney CBD

- 80% of new overseas migrants to Victoria resided within 30km of Melbourne CBD

Mirvac has always been a strong believer that urbanisation will remain a strong driver of residential markets. While at times this view was called into question during the pandemic and residential vacancy rates in some key inner-city areas such as Green Square and Zetland in Sydney or Docklands in Melbourne increased, they have turned around quickly. Residential vacancy rates swiftly tightened back to pre-pandemic levels through 2022 and rents are tracking above 2019 levels demonstrating the desirability of locations for their liveability, amenity and access to employment.

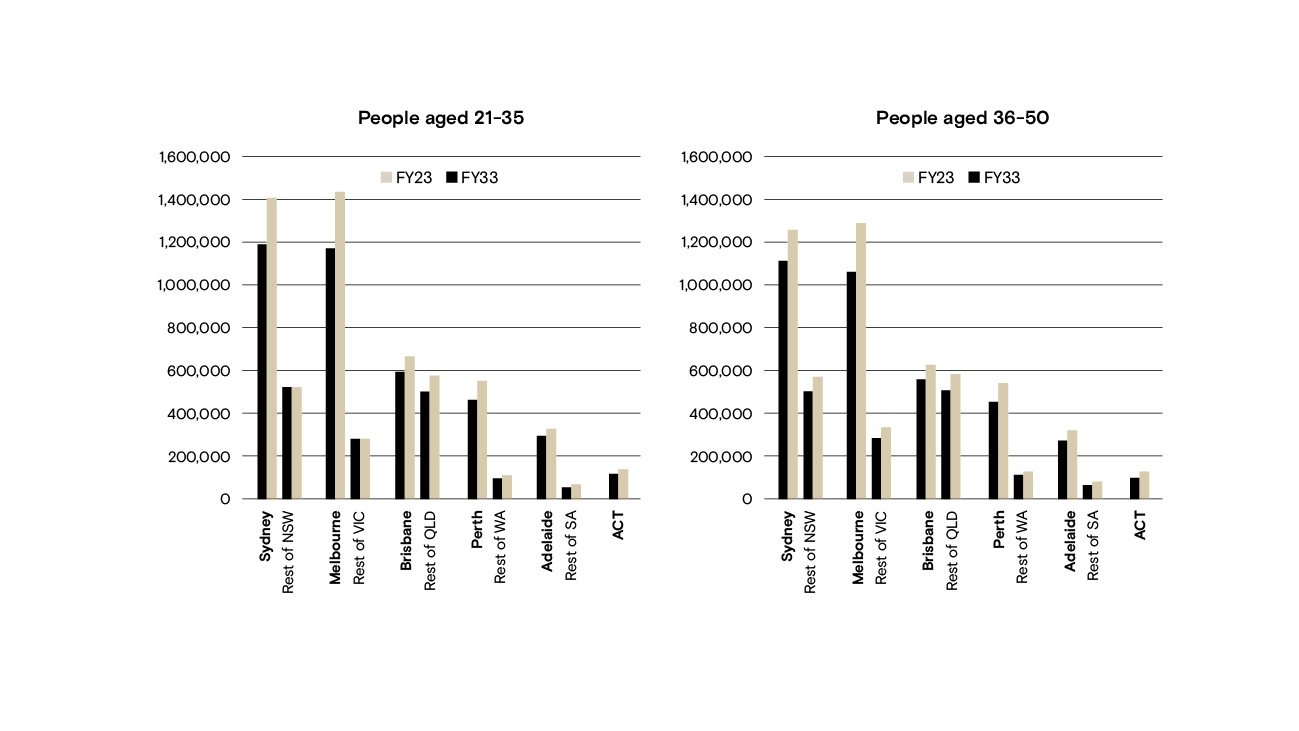

Population - longer term & next decade

Like many advanced economies, Australia’s population is aging. While this is pronounced at the national level, it is also true that our largest cities are expected to skew young. According to the latest Federal Government age cohort forecasts, the largest growing age groups by both absolute size and increase over the next decade will be aged 21-50 in Sydney and Melbourne where an estimated additional 800,000 people in these age cohorts will require housing. Amongst these will be many renters, first home buyers and upgraders. Perth and Brisbane are expected to see an additional ~325,000 people in these age cohorts over the same period, large numbers for cities of this size

Sydney

Nearer term economic forecasts are slower than the boom period seen in CY2022. Elevated inflation and rapid-fire RBA hikes are seeing an economy in transition. However, some key cushions remain and are important drivers behind the strength in the housing market.

The unemployment rate in Sydney is currently below 3% - a strong starting point for the labour market – and though it is likely to rise over the year ahead it is also expected to stay at low levels compared to history. The surge in international student numbers and international tourist levels continues to climb while an Aussie dollar trading at July 2023 below the US70c mark is a positive, given it makes Sydney (Australia’s largest service sector economy) and NSW more attractive, competitive destinations. State Government capital expenditure is forecast to step up to record levels. While state infrastructure pipelines have been commonplace for some time, public capital expenditure is set to average $29.2bn annually over the four years to June 2026, an unprecedented level in NSW history.

Supply: Sydney is facing a very low housing supply outlook. Over the next two years, Oxford Economics forecasts the number of new houses to fall by ~40% and a decrease in high-rise apartments of ~30%. As such, the volume of new Sydney dwellings completing in 2025 will be around the same levels seen in 2013/14 when population growth was much lower.

Melbourne

Following the resumption of migration and a technical change to the boundary, Melbourne overtook Sydney as Australia’s largest capital city. There is no looking back from here with Melbourne forecast to record the highest population increase of any city over the next decade. While the state’s post-COVID rebound is now giving way to slower growth from higher inflation and rate rises, the significant lift in hours worked, over the past year and resurgence in net migration inflows are important supports. The broader pipeline of non-residential construction remains positive with a large round of public works providing a big boost to infrastructure workload. There is now over $25bn in infrastructure work in the pipeline, such as the commencement of Melbourne’s massive North-East link, featuring 6.5km of tunnels, nearly doubling the value of work.

Overall, the resurgence in population growth is the key support to activity. ABS estimates show annual growth likely to be a strong 2.5% over the year in early 2023, well above the State Government’s previous forecasts of 1.4%.

Supply: Over the next 2-3 years Oxford Economics expects the volume of new houses to reduce by close to a third from mid-2023 to early 2026. Meanwhile the volume of new high-rise apartments is barely lifting and is expected to remain at levels last seen in 2012-2013.

Perth

The mild and brief pandemic disruptions in 2020 and 2021 have meant that the reopening dynamics have been less of a factor for Perth. Population is growing and forecast to increase 1.7% in FY24. Over the next four years, the state will welcome an additional 180,000 people, most of whom will reside in Perth.

This will be welcome news to employers given the state’s tight job market. Along with improved housing affordability, this has contributed to Perth being less exposed to the 2022 established dwelling price correction seen on the east coast. While Perth is experiencing a slowdown in economic activity from interest rate rises, there are important supports. Deloitte Access Economics analysis in June 2022 outlined $32bn of investment projects under construction and $20bn of committed capital expenditure. An additional $100bn of projects were under consideration or possible.

Supply: The supply-demand balance remains tight with sales in the established market running a long way ahead of new listings and stock of unsold dwellings dwindling. Consumer sentiment towards Perth dwelling price expectation was the highest of all Australian cities in June 2023, indicating locals expect prices to be higher in the year ahead. A shortage of quality new housing is behind this – the latest dwelling approval numbers for WA showed detached house approvals down 22% over the past year to May 23 and high-rise apartment approvals down 21%.

Brisbane

While the Queensland economy faces headwinds as the full impact of interest rate rises materialises, the recovery in net migration and population is a positive for Brisbane in the longer term.

Queensland’s population growth is higher than the state’s long-run average and above the national average. This has spurred an end to weakness in the established housing market seen in 2022, with Brisbane dwelling prices finding a floor in March 2023 and lifting to a 1% monthly increase by June 2023. Residential vacancy rates are very low with just 1% of stock available, marginally lower than Sydney and Melbourne.

Supply: The decline in house construction continues to shape the Brisbane housing market. Oxford Economics expects the volume of new houses will reduce by greater than 20%, from a peak in 2023 to early 2026. While apartment supply has not improved for some time, it’s worth noting that the volume of new apartments in early 2025 in Greater Brisbane is expected to be around 70% lower than the peak of 2018.